Market Commentary

It’s been a funny month in the stock market. To begin the month, the S&P 500 fell over 8% and on August 5th had its worst day in over 18 months as it fell 2.91%. Commentators blamed the fall on a weaker than expected July unemployment data, a sudden interest rate hike in Japan, and an overblown technology sector.

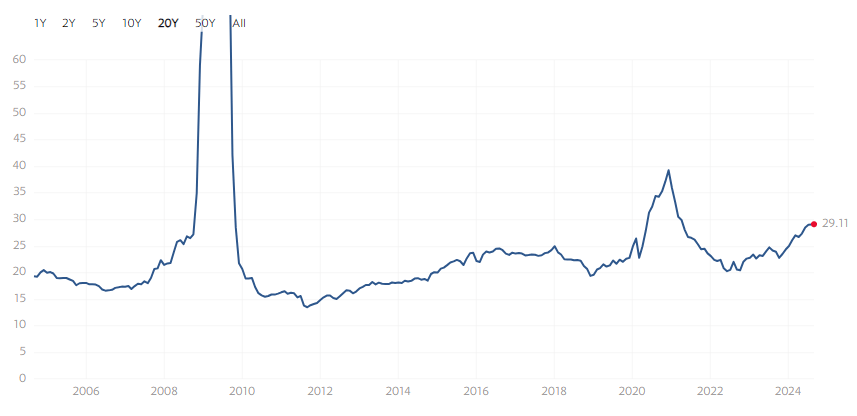

The US unemployment rate rose to 4.3% in July, an increase from 4.1% in June and the highest level since October 2021. This sparked concerns that the Federal Reserve was behind on cutting interest rates and that the labour market would continue to cool right into a US recession. The Volatility Index (VIX) reached its highest level for the year, and CNN’s Fear and Greed Index plummeted into Extreme Fear.

There’s no doubt that this reaction was irrational. Those who read the fine print of the jobs report would have known that the participation rate, which is the proportion of working-age people are either employed or seeking work, rose during the period. The participation rate is the denominator for unemployment rate, so when it rises the employment rate falls. In the absence of this increase in the participation rate, unemployment would have been unchanged at 4.1%. Strong immigration and cost of living pressures are the likely reason for the increase in participation rate.

Since then, July consumer spending came in much stronger than expected, seemingly calming investors’ nerves.

Prior to August, anticipation of a Fed rate cut and AI enthusiasm had driven stocks to record highs. I believe that the July jobs report was no more than a catalyst in correcting a market that was overblown. The unemployment number was simply convenient for investors to point the finger at in justification for the selloff.

The problem now is that in the rally since August 5th the S&P 500 has surged roughly 10% and we are essentially back to where we started before the drop. Shares of technology stocks which were said to have been overblown, like NVIDIA, have rebounded sharply and are trading back at elevated levels.

Growth Stocks

The combination of a central bank rate cut and potential growth from AI provide a great environment for growth stocks. This combination has driven the PE ratio of the S&P 500 Growth Index to 34.9, compared to that of the S&P 500 Value Index at 18.7, which has actually declined for the year.

The unfortunate thing is that 1. rate cuts have been anticipated for a long time and are most likely already priced in and 2. growth expectations are so high that one can more easily imagine being disappointed than pleasantly surprised.

I am reminded of the old saying along the lines of “you know stocks are overvalued when somebody you don’t know, such as the shoeshine or taxi driver, start talking stocks.” In other words, after seemingly everyone has bought them, who will be left to fill the buy side and support prices? I am unsure whether that measure applies to AI stocks yet - maybe you have experienced it for yourself - but it certainly feels as though we are getting dangerously close to that point.

My goal in the stock market is to buy shares in high-quality companies when they are underappreciated and therefore undervalued. So even though I love technology stocks, I just don’t believe now is the time to be buying them. Moreover, I know that there will be more opportunities to buy when the hype subsides, as it always does.

Lululemon (LULU)

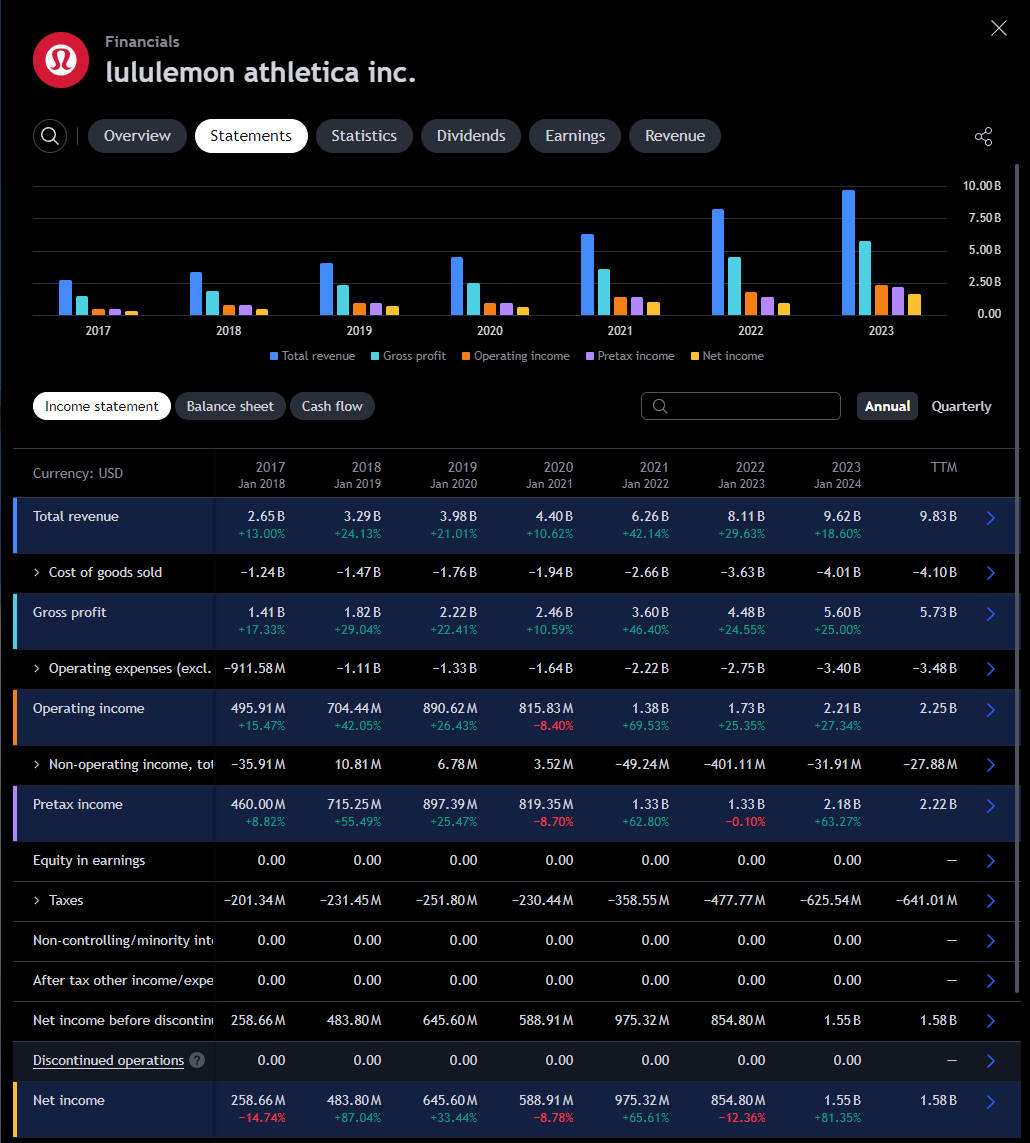

So what am I buying? During the month I started a position in Lululemon (LULU). The company sells clothing for a variety of sporty activities, including yoga, running, and training. Its yoga pants have become very popular recently for being both comfortable and fashionable.

The company has historically grown revenue between 20% and 30% every year, with earnings growing even quicker. That growth appears to have slowed this year, with revenue for 1Q24 up only 10% on the year before.

This has sparked concerns that the brand has reached ubiquity in the US market, which accounts for 65% of sales. This, together with a botched launch of its “Breezethrough” leggings and departure of its Chief Product Officer, have caused shares to fall roughly 50% this year.

However, the US is not the company’s only market. In 1Q24, international revenue grew 35% with most of it coming from China. China represents a significant opportunity for growth due to shifting demographics and consumers increasingly adopting an active lifestyle. The company currently has 127 stores in China versus 438 in the US.

Market expansion remains a core growth pillar for the company, together with product innovation and guest experience. Furthermore, the company is sticking to its 2026 revenue target of $12.5B, which marks 27% growth on the last twelve months.

Lululemon’s Power of Three x2 Growth Plan

Shares are currently trading at a PE of 21.29x, which is the lowest they have been in the last five years. This is not only cheap on a historical basis, but also represents a discount to peers such as Nike at 23x and Adidas at 29x. Nike’s earnings have typically grown in the high single-digits over the last decade.

The company also has a stellar balance sheet, with $1.9B in cash and no debt! The company uses its mountains of cash to continue to purchase shares. In May, the company’s directors increased its share repurchase program by $1B to $1.7B. At a market cap of $34B, this represents a yield of about 5%. Clearly the directors see the stock as undervalued if they are willing to increase buybacks by this much.

I believe the present slowdown will prove transitory as the company still has a long runway for growth through international expansion. As for the issues with its Breezethrough product, it is not the first time the company has faced challenges like this. In 2017, the company reported an issue with the colours in its Spring collection which caused analysts to downgrade the stock saying the issue would “likely create an overhang for the stock for the foreseeable future.” Of course, the company took responsibility for the issue and resolved it swiftly. Shares finished the year up 50%.

All in all, I believe Lululemon is a high-quality company and the plethora of concerns plaguing the stock are providing an attractive entry point. It is precisely when investors act fearfully, focus on the negatives, and lose sight of the long-term, that the best opportunities arise, which is exactly what I believe is happening here.