Market Commentary

Markets continued to trudge upwards this month, with US and Aussie stocks reaching all time highs. Stocks were buoyed by the Federal Reserve’s decision to lower interest rates by a half-percentage point following a fall in inflation to 2.5% for August. The advent of a rate cut was largely expected, but the size of the cut was larger than the 25 basis points anticipated.

The larger than expected cut was likely in response to elevated unemployment, which Jerome Powell said he was shifting the Fed’s attention to last month. Unemployment stood at 4.2% in August, which was down slightly from June but still above what the Fed would consider its target of “maximum employment.”

The greater than expected interest rate cut is highly supportive for stocks, but markets continue to appear stretched. Ironically, shares fell in high volume on the announcement of the Fed rate cut in classic “buy the rumour, sell the news” fashion, as if traders thought “well, there’s nothing to look forward to anymore: sell!” It was in the next trading day that shares rose, with the S&P 500 up 1.87%, as if investors had suddenly come to their senses, although volume was much lower. This action is revealing of the fact that this market has become disconnected from fundamentals and is instead being driven by a mild case of irrationality or complacency (which is a form of irrationality).

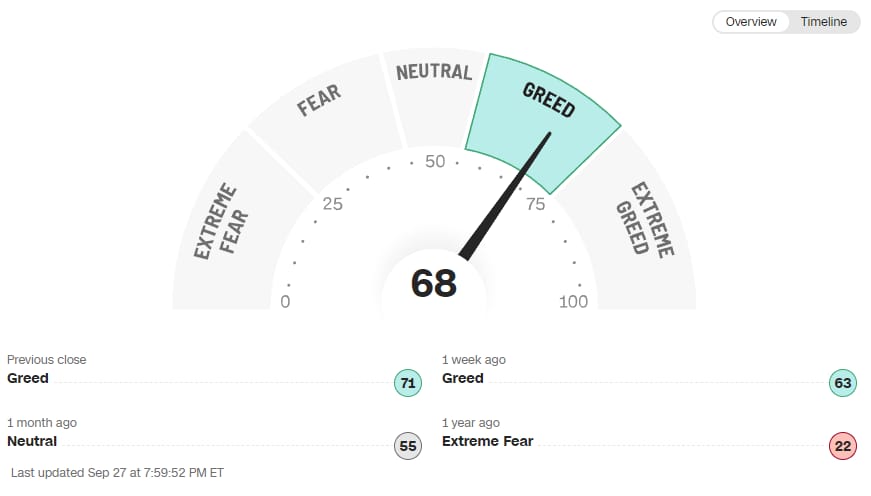

This conclusion is supported by CNN’s Fear & Greed Index, which has shifted further and further towards Greed as the market has inched higher.

The S&P 500 chart below indicates that sentiment may be about to shift. Notice that the candlestick is red each time the Index makes new highs, as if each additional step upwards is a bit too far. The bears (sellers) are lurking just out of reach, gently testing the market at each successive high, and the strength of the bulls (buyers) is waning. An analysis of momentum, as indicated by the MACD below, supports this. Momentum has diverged with the market and trended down from August, which is historically indicative of a weak trend (this is not to mention that the MACD has just flashed a bearish crossover, indicating this trend could change imminently).

I wrote last month that sentiment appeared to be elevated and valuations stretched in anticipation of interest rate cuts. Now the anticipated rate cut has occurred and valuations still appear to be stretched, and the weight of the evidence suggests that markets are due for a correction in the near-term. And there are plenty of catalysts for this happen, from escalation of war, to the US election (this historically has had minimal effect on the stock market, yet investors seem to focus on it nonetheless), to any number of economic results that could indicate a recession.

Amazon (AMZN)

What stocks am I buying? None. A rate cutting environment is great for stocks, but for the reasons discussed above, I suspect the market will experience a moderate correction in the near-term. Therefore, I prefer to hold off on any significant purchases until such a correction. However, I can still give you a stock to add to your watchlist, as it is certainly on mine.

Amazon is a $2 trillion technology titan that dominates the e-commerce and cloud computing spaces. It started as an online bookseller in 1994. After success selling books and other items, it realised it could package the infrastructure that the site ran on and sell it as a service to other online businesses and launched Amazon Web Services in 2006.

Today, its e-commerce platform, Amazon.com, is the largest in the world and accounts for nearly 40% of e-commerce sales in the United States. The success of this business allowed Amazon to adopt a cross-subsidisation strategy, whereby it could expand into new markets and compete without concerns about profitability in order to undercut competitors. Amazon has acquired over 100 other businesses and owns over 40 subsidiaries in industries such as entertainment, groceries, and healthcare. In each industry, it leverages its enormous size and capabilities to benefit from economies of scope.

Amazon is a highly future-proof business. The sheer number and variety of forward-facing businesses it is involved in is a catch-all for any and every significant trend you can think of.

Recently, investors have been focusing on the Amazon Web Services (AWS) segment, which is the leading cloud service provider with over 200 services on its platform. AWS is highly profitable and has been a significant source of growth for the business in the last decade. It has also been a beneficiary of the recent hype surrounding AI. Users are able to train, test, and deploy their own custom AI models all through the AWS platform.

Looking at the fundamentals, Amazon has traditionally grown revenue at 20%+ per annum and earnings at an even greater pace. The company runs an abnormally low profit margin, typically around 5%. But this is intentional, due partly because Amazon deliberately prices its products extremely low to gain market share and partly because it reinvests most of its profit back into the business in accordance with its cross-subsidisation strategy.

Because of Amazon’s low profit margin, using the PE ratio to assess valuation can be misleading. Instead, we can use the EV/EBITDA ratio. The EV/EBITDA ratio, which has ranged from around 17 to as high as 45 for Amazon, currently stands at 19.94. For comparison, Microsoft, which is the second largest cloud computing provider, is trading at 24.94. And Walmart, which has the second largest share of e-commerce sales in the United States, is trading at 17.24. For further comparison, Walmart’s earnings is forecast to grow at 10% over the next five years, while Amazon’s is forecast to grow at 30%.

All of this indicates to me that Amazon is nowhere near fully valued. Amazon is an extremely diverse and profitable business, with so many avenues for future growth. This is one I am eager to buy on the first sign of weakness in the general market.