Market Commentary

Last month, I wrote that the weight of the evidence suggested the market was due for a correction in the near-term. On Monday October 1st, crude oil prices climbed and stocks fell after Iran launched a missile attack on Israel. Technology stocks were hit particularly hard as analysts suggested early signs were showing weaker-than-expected demand for Apple’s iPhone 16.

Unfortunately, the buy-the-dip opportunity was short-lived. Investors quickly shrugged off their concerns (keeping with the trend of late) and shares recovered to all-time highs about a week later.

Also this month, Q3 earnings season commenced in the US. Here are some highlights.

October 11 - JP Morgan shares rose 4.44% after it beat earnings and raised guidance. The bank simultaneously made the call that the Federal Reserve had achieved a soft landing, meaning inflation has been successfully tamed without the economy falling into a recession.

October 17 - Taiwan Semiconductor, the world’s largest contract chipmaker, rose 9.79% as it reported earnings growth of 54% over the year and said it expects strong demand for its smartphone and AI chips going forward.

October 17 - Netflix shares rose 11.09% after it beat earnings and guided to revenue growth of 14.7% for Q4.

October 23 - Tesla stock had its best day since 2013, rising 21.92%, as it also beat earnings and Elon Musk said he expects vehicle growth to reach 20% to 30% next year on reduced costs and automation.

As of October 25 - 75% of S&P 500 companies that reported thus have reported a positive Earnings per Share surprise.

These positive earnings surprises are encouraging because it shows that economic conditions are improving faster than analysts anticipated. The Netflix result is particularly encouraging because (as much as you may not be able to live without it) a Netflix subscription is a discretionary, or non-essential, item. In other words, the fact that consumers globally are increasingly willing to fork out an additional US $6.99/month is a sign that they are beginning to feel more comfortable about the state of the economy.

These positive results were not only pleasant, but necessary. Coming into October, shares were already trading well above their long-term average relative to earnings. Investors were paying up for stocks in anticipation of high earnings growth, making shares look expensive compared to present figures. High prices also increase downside risk, because if investors are wrong about future earnings, or something happens to prevent the expected outcome from playing out (such as escalation of the war in the Middle East), prices must fall. We saw this briefly when concerns arose surrounding Apple’s iPhone 16 sales, causing the stock to drop 2.91%.

As positive earnings reports come in, valuation metrics like the Price to Earnings (PE) ratio can fall without a corresponding fall in price (earnings is in the denominator and causes the PE ratio to fall when it rises). In other words, shares become cheaper without experiencing a fall in price.

However, as seen below, shares still remain well above their 5-year and 10-year averages compared to forward earnings estimates. So even though these positive earnings surprises have been great, downside risk still remains elevated. And there are plenty of potential catalysts on the horizon to introduce uncertainty and trigger a re-evaluation by investors - the most obvious of which being the 2024 US election.

Tariffs

Historically, the party holding office has had little statistical relevance to the performance of the stock market. However, the latest polling and betting markets are pointing to a victory for Donald Trump on November 5th, and bond markets are moving in anticipation. So, what does a Trump victory look like and what does it imply for the economy?

The economic policy most associated with Trump is tariffs. Tariffs are a tax imposed by the government on imports of particular goods into the country. Tariffs are beneficial when the price of the good being imported is lower than the price that it is domestically available. In this situation, domestic suppliers miss out because consumers simply opt to import the good from other countries. This negatively impacts domestic jobs and government revenue (the government cannot tax producers in other countries). The idea behind tariffs is to increase the price of imported goods in order to protect domestic suppliers, increase jobs, and recover part of the government revenue lost to other countries.

How tariffs impact domestic supply and demand

The disadvantage of this is that consumers no longer have access to cheap imported goods and must pay a higher price. Trump intends to offset this effect with tax cuts across the board, including extending the provisions of the Tax Cuts & Jobs Act introduced in 2017, reducing the corporate tax rate to 15% for domestic suppliers, and eliminating tax on tips and Social Security benefits.

Another disadvantage of tariffs is their potential to ignite trade wars with other countries. This refers to when other countries retaliate by implementing their own tariffs on goods from the domestic country. This can negatively impact domestic businesses that export their products globally. This occurred with the US-China Trade War during Trump’s administration in 2018, which significantly impacted the automotive, agriculture, and technology industries, which had a significant portion of revenue come from China. Trump’s tariffs were maintained by Joe Biden after Trump left office and are still in place today.

Tax is the government’s primary source of revenue, and economists are estimating that the tax revenue generated from Trump’s tariffs will not be enough to offset his tax cuts. The estimated net effect of Trump’s policies is an increase in the budget deficit of around $5.8 trillion over the next 10 years.

Other than tax, the government can raise money through borrowing. It does this by issuing government bonds, which are debt securities that represent an “IOU” from the government to the bondholder. Investors are rewarded for lending to the government through interest payments.

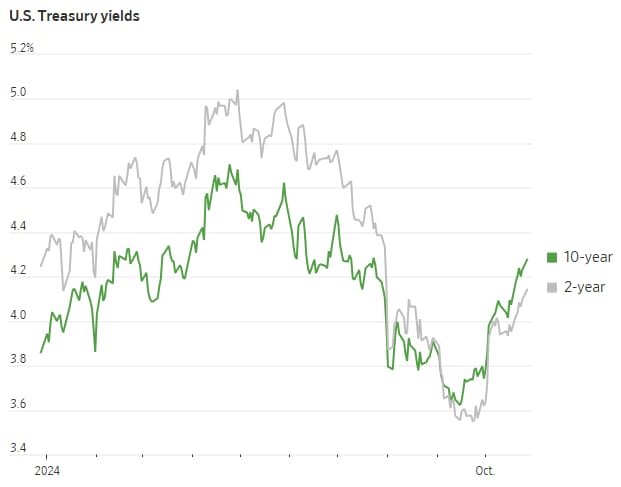

Due to the prospect of a greater government deficit, investors are now anticipating that the Federal Reserve will not be able to cut interest rates as much as previously expected. In other words, to cover the loss in tax revenue the government will need to issue more bonds and interest rates must, therefore, be higher in order for investors to buy them.

Government Debt

Why does the budget deficit matter? Much like a business, having some amount of debt is completely normal for governments as it allows them to spend on important things, like infrastructure, health care, defence, and education, that they otherwise couldn't afford. In fact, for this reason almost all countries carry some level of debt.

For context, US national debt of $35.8 trillion is the largest of any country in the world, but it is also the country with the largest GDP in the world at $29.35 trillion. US national debt ranks 39th largest in the world compered to GDP.

If national debt gets too high, there is a risk that the government will be forced to partially shutdown (to reduce spending) or, in extreme circumstances, default on its obligations. This would cause millions of the investors holding government bonds to lose money, the US dollar to implode, and the US to most likely fall into recession, and would have widespread implications around the world.

Is this likely to happen? No. The US is considered one of the safest governments in the world. As mentioned above, the US has the largest economy in the world, and it also has many systems in place, like the Federal Reserve, that exist to prevent this sort of thing from happening.

Bottom Line

What does this all mean for the stock market? As mentioned earlier, the political party holding office has statistically had little effect on the performance of the stock market. This is because institutions like the Federal Reserve, which are independent from the White House, exist to ensure long-term economic stability.

In Trump’s previous term, the Tax Cuts & Jobs Act was highly supportive for US stocks, with the S&P 500 rising over 20% in 2017. However, some of the largest stocks, like Apple, Tesla, and Intel (at the time worth $200B), were negatively impacted by the US-China Trade War and dragged down the S&P 500 in 2018.

If elected, Trump’s proposed tax cuts will likely have a similarly supportive effect on US stocks. On the other hand, Trump intends to implement new tariffs, including a universal 10-20% tariff on all imports. However, due to widespread deglobalisation since 2018, the world is very different to what it was back then, and it is unclear whether more Trump tariffs will result in a renewed Trade War.

The more important thing to look at for investors wondering where to put their money is the unique effects that Trump’s policies, fiscal and otherwise, will likely have on different sectors of the market.

Energy - Trump is expected to prioritise domestic oil and gas production, which will benefit stocks like Exxon Mobil and Chevron. However, increased supply may lead to a reduction in energy prices in the long-term.

Aerospace & Defence - Trump will likely require US allies to increase how much they pay the US for their defence, benefiting companies like Lockheed Martin, Northrop Grumman, and Raytheon. Trump also has a focus on making the US a leader in space.

Finance - Deregulation and the cutting of corporate red tape could reduce costs for companies like JPMorgan Chase, Bank of America, and Goldman Sachs.

Technology - Large tech stocks that have significant international exposure, like Apple and Nvidia, could be negatively impacted by other countries implementing tariffs.

Healthcare - The healthcare sector could experience volatility as details of Trump’s plan and potential repeal of the Affordable Care Act become clearer.

As discussed, shares remain at historically high valuations and downside risk is elevated. It is not uncommon for shares to experience volatility following an election, even if the outcome was anticipated, simply because investors are forced to digest changes in policy and adjust their portfolios accordingly.

If Trump wins, I recommend considering the stocks in the abovementioned sectors that stand to benefit from his presidency. More generally, the long-term outlook for the stock market as a whole is extremely positive, so you should look for opportunity in any volatility that the coming days and weeks may provide.